Malaysia is now one of the hottest destinations in Southeast Asia. And by hot, we mean quite literally as the nation’s tropical climate means that both peninsular and insular Malaysia, are pleasantly warm all year-round.

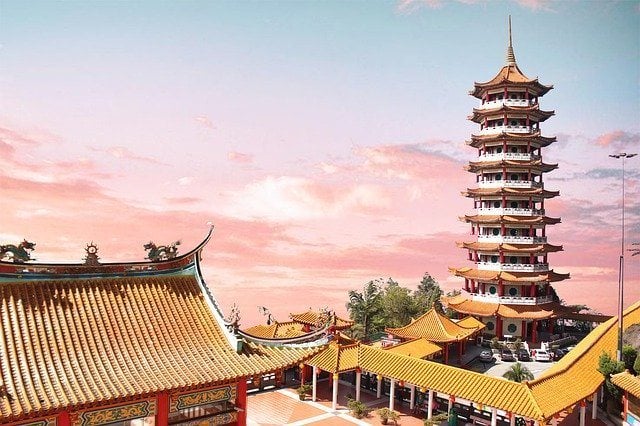

But wait, there’s more besides the divine weather. Malaysia is a rich combination of cultures with both a large Chinese and Indian population. The scenery spans from paradise islands to one of the world’s oldest tropical rainforests as well as emerald tea plantations. The cities offer cultural immersion and we’d defo recommend getting over to Borneo for your chance to hang out with Malaysia’s superstar residents – Bornean orangutans!

We could wax lyrical about Malaysia all day but we’ll restrain ourselves and get onto today’s subject. The topic of today is travel insurance for Malaysia!

Month to month payments, no lock-in contracts, and no itineraries required: that’s the exact kind of insurance digital nomads and long-term traveller types need. Cover yo’ pretty little self while you live the DREAM!

Visit SafetyWingDo I Need Travel Insurance For Malaysia?

The Broke Backpacker is supported by you. Clicking through our links may earn us a small affiliate commission, and that's what allows us to keep producing free content 🙂 Learn more.

Like the majority of Southeast Asian countries, insurance is not mandatory for traveling to Malaysia. You’ll still get your extremely generous free visa without Malaysian insurance. So if you don’t need to fork out on insurance, then some of you may wonder why even bother?

In fact, Malaysia is considered one of the safest countries in the region and violent crime is rare. Natural disasters seldom strike in Malaysia either although earthquakes can happen. The leading natural danger is actually flooding. More than 6,000 Malaysians were affected by flash floods and landslides in 2017 alone but those statistics are actually quite similar in the UK.

So there’s not really anything to insure against right? Wrong.

Like anywhere in the world, tourists are a target for petty theft, and every year visitors to Malaysia are relived of phones, passports and cash wads. As a tropical destination with lots of outdoor activities to choose from, you may also be exposed to accidents such as a stumble in the jumble, or a bite from a mosquito infected with dengue fever. All in all, we urge our intrepid backpackers to chew over their options even if that means just out the cheapest Malaysia travel insurance. You know, just in case.

Need more convincing? Check out these other reasons why you should have travel insurance!

Unlock Our GREATEST Travel Secrets!

Sign up for our newsletter and get the best travel tips delivered right to your inbox.

Healthcare in Malaysia

Should you need them, the medical facilities in Malaysia are very reliable, in fact Malaysia was recently rated as having the best healthcare in the world. Malaysian healthcare is governed by the Ministry of Health. The country has an efficient and widespread system of healthcare, operating a two-tier system; a government-funded universal healthcare system plus a private service. Private hospitals are more expensive and offer Western standards.

Private clinics in Malaysia could set their own fees. Practitioners at private hospitals typically charge between RM30 and RM125 ($7 USD – $29 USD) for consultations and clinics now charge within that same range. The more distinguished the hospital, the more you will pay. If tests and treatment are required, that will be added to the bill as well as any prescription medicine. It’s also worth mentioning the pharmacies in Malaysia, these can be found in abundance, and for something minor, the pharmacists may be able to give you some pointers.

If you require medical attention in Malaysia, simply locate your nearest hospital or clinic and turn up. You will complete all the necessary information and wait to be seen. Waiting times at private hospitals are shorter than public ones, but don’t worry, in an emergency, you will be seen promptly, wherever you are. You will need to provide details of your Malaysia travel insurance if the anticipated fees are more than you have access to.

Crime in Malaysia

As a traveler, the crime you are exposed to in Malaysia is nothing out of the ordinary. Petty crime does occur and is more likely to happen in busy cities and around crowded touristic attractions.

The bustling Malaysian capital, Kuala Lumpur, ranked 35th out of 60 cities in the Safe Cities Index 2019. The report spanned digital, health, infrastructure, and personal security. Petty, violent crime and organized crime, corruption levels, and terrorist attacks were the reason for the score.

There are a few areas and places in Malaysia which you may be better avoiding. These include Bornean Sabah, the Eastern Islands Sipadan, and around. If you head there to dive, your Malaysia travel insurance may not cover you so do check.

Additionally, Malaysia is considered to have a moderate risk of terrorism across its cities.

Issues Facing Travelers in Malaysia

Much of your time in Malaysia will be spent stuffing your face with Nasi Kandar and wandering around grand buildings. Some of the key issues facing travelers can all be insured against on your Malaysia travel insurance. Typical issues affecting safety in Malaysia include:

- Bankruptcy of tour operators – While Malaysia lends itself to exploring independently, there are heaps of tours available it in case you don’t fancy getting lost in the Taman Negara or want that (almost) guarantee of seeing rare wildlife. But tour operators can go into liquidation overnight meaning you lose your money and your tour. Figure out the best insurance for Malaysia to protect you should this arise!

- Emergency medical attention – Perhaps you run into trouble in the jungle, like suffer a reaction to a bug bite or break an ankle. Or get struck down with an illness out of the blue and need antibiotics. That’s where the emergency medical clause in your Malaysia travel insurance springs to action.

- Theft of personal goods – As we said, such petty crimes can take place anywhere – even in your home town. In Malaysia, perpetrators may roam dark city streets, lurk on night buses, or prowl at packed events. Always use the locker at your hostel and keep your valuables secure on your person. If you get the cheapest Malaysia travel insurance, consider adding personal possessions coverage.

Common Activities in Malaysia

There’s a reason why Malaysia’s annual tourist numbers are on the increase, plus why holidays are staying for longer! There are tonnes of cool activities to do in Malaysia. Top contenders include:

- Trekking – Malaysia has heaps of awesome trekking opportunities. Visit Cameron Highlands and skip through tea plantations, get muddy in Taman Negara, or scout for wildlife in Borneo. But if you take a tumble, check your Malaysia holiday insurance covers you in the event of an emergency evacuation. Or, at the very least, medical assistance to get you back on your feet.

- Scuba diving – Malaysia has erupted as a top dive spot over recent years. And no wonder, with the pristine Perhentian Islands and Tioman Islands! If you do dive, be sure to respect the surface interval before flying. Additionally, ensure your travel insurance in Malaysia covers you to the depth you are qualified for.

- Rent a vehicle – When in Southeast Asia, do as the locals do and rent a scooter! This is the best way to explore islands like Langkawi if you’re a quick touring itinerary AND have travel insurance. If you’re not keen on two wheels, go for the full four. Car rental is common in Malaysia, and the roads are less frenzied. But ensure you get the best insurance for Malaysia to cover yourself, the vehicle, and your valuables in case of an incident. And with a motorcycle, ensure you have the correct license to validate your insurance.

Things go wrong on the road ALL THE TIME. Be prepared for what life throws at you.

Buy an AMK Travel Medical Kit before you head out on your next adventure – don’t be daft!

Buy on REIWhat Should Travel Insurance in Malaysia Cover?

As a rule, most Malaysia travel insurance will include the following;

- Emergency Accident & Sickness Medical Expenses

- Baggage and Personal Property

- Emergency Evacuation and Repatriation

- Non-Medical Emergency Evacuation

- Trip Cancellation

- Trip Interruption

These are key terms to look out for when comparing travel insurance providers. Let’s take a closer look at what each one of these actually means.

Emergency Accident & Sickness Medical Expenses

The headline for most travel insurance policies is emergency medical costs. If you are in a car crash or come down with meningitis, you want to rest easy knowing that any ensuing medical costs will be taken care of.

In case you have never seen a medical bill, let us assure you that they can be expensive. A friend of mine once racked up costs of $10,000 in Costa Rica and then a nasty infection in Thailand cost him $2,000.00 for just 2 days in hospital. Ouch.

Pre-existing medical and health conditions may not be covered or may come at an additional premium.

Ideally, Emergency Accident & Sickness Medical insurance should offer at least $100,000.00 of coverage. Whilst British the NHS is free at the point of service, remember they do have the right to recover the monies from non-residents.

Baggage and Personal Property

Baggage and Personal Stuff coverage covers the value of your personal property. It’s most common application is for lost luggage and. Many policies also extend this to cover “on the ground” theft.

The limits on this vary between policies but rarely exceed $1000 with a maximum item value between usually up to $500.

This is fine for many people but if you work while travelling with important gear (eg. a laptop and camera), you may also wish to think about taking out a separate gadget cover.

We’ve tested countless backpacks over the years, but there’s one that has always been the best and remains the best buy for adventurers: the broke backpacker-approved Osprey Aether and Ariel series.

Want more deetz on why these packs are so damn perfect? Then read our comprehensive review for the inside scoop!

View on Osprey View on REIEmergency Evacuation and Repatriation

Emergency evacuation covers the cost of sending you back to your home country in a sickbed. Let’s say that the above mentioned car crash is a nasty one and the decision is taken to send you home for further treatment; this will take care of the high, associated costs.

Repatriation is the cost of sending your earthly remains home in the tragic event you die overseas. The costs of this are generally huge, and it is not a burden I would want to leave to my family. Whilst this is rare, every now and then I do come across a Facebook or “Go Fund Me” page for somebody’s body to be flown home.

Non-Medical Emergency Evacuation

Non-medical Emergency Evacuation is when you have to be evacuated from your destination because of some unexpected crisis. Classic examples are outbreaks of war/civil unrest and earthquakes that decimate infrastructure.

Emergency evac insurance covers the costs of having to book a last minute flight (which can be expensive) and will also cover accommodation costs if you end up being flown to a random, “safe” country rather than going straight home.

Trip Cancellation

Being forced to cancel a trip you were looking forward to sucks. But being left out of pocket just rubs salt into that festering wound. Trip Cancellation cover can help you recover non-refundable costs such as booked flights and hotel costs.

Note that you can’t claim under this simply because you changed your mind or broke up with your boyfriend. Acceptable cancellation reasons are things like sickness, family emergencies, bereavement, natural disaster and war – you get the gist.

Trip Interruption

Trip Interruption is when something goes wrong with a part of your trip leaving you out of pocket. For example, when your hotel burns down and you are forced to book another one. Or when your flight home is cancelled and you need a few extra nights at your hotel. These are just a few examples of when you may need to reply on trip interruption.

Anything Else?

The above is what we consider to be the basic, bare-bones of travel insurance policies. However, some policies do offer a few more aspects and the best Malaysia travel insurance policies may also offer the following;

Adventure Sports and Activities

Note that some travel insurance policies do not cover adventure sports and activities. The definition of adventure sports and activities does vary between providers but for example, can include;

- Trekking

- Rafting

- Muay Thai

- Paragliding

- Diving

- Soccer practice….

If you’re someone that loves to chase adventure travel thrills, it is wise to check that your insurance provider is covering it. Broken ankles hurt enough without having a $5k Doctors bill attached to them.

Accidental Death and Dismemberment

This one doesn’t cover any travel-related expenses but instead it basically provides you, or your family with some compensation in the event that something awful happens to you. If you die, your loved ones get a payout. Or, if you lose a finger or something, YOU get a payout.

It’s like having a bit of life cover attached to your travel insurance. I know that not everybody is altogether comfortable with the concept of pay-outs for life & limb – I guess it kind of goes something like this;

“Well dear, I’m afraid there is good news and bad news. The bad news is that our beloved son little Jimmy died on his trip to Malaysia. The good news is that we get $10k! Malaysia here WE come!”

Gear and Electronics Cover

Some insurance policies cover electronic gadgets and some don’t. Those that do, may charge an additional fee, and they generally limit the maximum item value. If you only travel with a phone or tablet, your travel insurer may well cover it entirely. On the other hand, if you are traveling with a good laptop then you may wish to consider obtaining gadget cover.

I have personally had gadget cover on my MacBook Pro for years.

A new country, a new contract, a new piece of plastic – booooring. Instead, buy an eSIM!

Jetpac eSIMs work just like an app: you download it, pick your plan, and BOOM! You’re connected the minute you land. It’s that easy.

Read about how e-Sims work or click below to see one of the top eSIM providers on the market and ditch the plastic.

Grab an eSIM!What Is The Best Malaysia Travel Insurance?

Whilst they may all seem the same, not all insurers are. Some travel insurers are cheaper than others while others offer higher coverage amounts. Some are infamous for not paying claims whilst others are celebrated for being fair and helpful.

Travel insurers – always the same yet always different. It isn’t possible (or legal) for us to say that anyone of them is the best, or is “better” than the others. No. Insurance is a very complex product and any policy takes into account a whole lot of data and a wide set of variables.

Remember that the “best” travel insurance always depends on where you are going, when you are going there and ultimately upon you and your needs. The best travel insurer for one trip, may not be the best for a different trip.

Below, we will introduce a few of the many travel insurance providers on offer. These are all firms we have used ourselves over the years.

| What is Covered? | Iata Seguros | SafetyWing | Heymondo Single Trip Plan | Columbus Direct |

|---|---|---|---|---|

| Emergency Accident & Sickness | $200,000 | $250,000 | $10,000,000 | $1,000,000 |

| Baggage & Personal Property | $1000 | $3000 | $2,500 | $750 |

| Emergency Evacuation and Repatriation | 100% of cost | $100,000 | $500,000 | $1,000,000 |

| Non-Medical Emergency Evacuation | $0 | $10,000 | $10,000 | $0 |

| Trip Cancellation | $1,500 | $0 | $7,000 | $1,000 |

| Trip Interruption | 100% of cost | $5000 | $1,500 | $750 |

SafetyWing

SafetyWing is a relatively new player in the travel insurance space but are already making big waves. They specialise in cover for digital nomads and they offer open-ended cover on a monthly subscription basis. Because they primarily cover digital nomads, they don’t offer much in the way of trip cancellation or delay so do take that into consideration.

However, SafetyWing really excels on the health side of travel insurance, covering dental and some complementary treatments. In fact they even allow young children to be covered for free.

If cancellation and delay is not a concern for you or if you will be spending some considerable time on your trip, then consider SafetyWing travel insurance.

- Emergency Accident & Sickness Medical Expenses – $250,000

- Baggage and Personal Property – $3000

- Emergency Evacuation and Repatriation – $100,000

- Non-Medical Emergency Evacuation – $10,000

- Trip Cancellation -$0

- Trip Interruption – $5000

If you need more information or want to get a quote, then you can visit the website for yourself.

World Nomads

World Nomads have been insuring backpackers for years now. World Nomads specialise in backpacker travel insurance and their policies cover long way travel on one-way tickets, trips to multiple countries, and a whole lot of adventure activities. World Nomads are well used to dealing with backpackers like us, and they are regularly recommended by travel bloggers and industry insiders. We love them.

They offer 2 different policies depending on your needs. The Standard Plan is standard & the Explorer Plan covers a whole host of high risk, high fun activities. World Nomads are also one of the few travel insurers who will write you a policy after starting your trip. The one downside for us is that they don’t cover Pakistan.

Let’s look at the maximum coverage amounts with both the Standard & Explorer plan.

- Emergency Accident & Sickness Medical Expenses -$100,000/$100,000

- Baggage and Personal Property – $1000/$3000

- Emergency Evacuation and Repatriation – $300,000/$500,000

- Non-Medical Emergency Evacuation – $25,000/$25,000

- Trip Cancellation -$2500/$10,000

- Trip Interruption – $2500/$10,000

If you want more info or to get a quote then visit the World Nomads site for yourself and take a look.

Faye

The savvy fin-tech insurer Faye provides whole-trip travel coverage and care that brings out the best in each journey with industry-leading technology that enables smarter and smoother assistance with faster claims resolutions. Their excellent app-based travel insurance covers your health, your trip and your gear all via an app that provides real-time proactive solutions, quick reimbursements and 24/7 customer support.

If you ever do need to make a claim, then you simply log in to the app and the claim will be assessed super quickly from anywhere in the world! My friend made a claim and was able to manage everything directly on the app. She was even able to purchase ‘Cancel for Any Reason’ Insurance that allows you to quite literally cancel for any reason, and be refunded up to 75% of non-refundable bookings.

Best of all, if the claim is successful then the funds will be immediately credited to the smart wallet on your phone or device and ready for you to spend.

Columbus Direct

Named after one of history’s greatest (and most divisive explorers), Columbus Direct also specialise in insuring adventure-hungry explorers like us. They have been providing award-winning insurance for 30 years. What we like about this plan is that it does cover small amounts of personal cash. However, Gadget Cover is not available.

Columbus Direct actually offers a number of different travel insurance plans. Below we have focused on 1 of these and have set out the coverage amounts for the Globetrotter plan.

- Emergency Accident & Sickness Medical Expenses – $1,000,000

- Baggage and Personal Property – $750

- Emergency Evacuation and Repatriation – $1,000,000

- Non-Medical Emergency Evacuation – $0

- Trip Cancellation -$1,000

- Trip Interruption (“Catastophe”) – $750

If you need more information or want to get a quote, then you can visit the website for yourself.

Iati Seguros

Iati Seguros is a Spanish based travel insurance company that we have personally used and loved. You will notice that they provide competitive cover amounts for the key travel insurance areas, and are competitively priced. So far we have heard nothing but good things about them.

They also offer multiple ones, but we have focused on the Standard Plan although we wholly encourage checking out all plans for yourself to identify the best one for your needs.

Standard Plan

- Emergency Accident & Sickness Medical Expenses – $200,000

- Baggage and Personal Property – $1000

- Emergency Evacuation and Repatriation – 100% of cost

- Non-Medical Emergency Evacuation – $0

- Trip Cancellation -$1,500

- Trip Interruption – 100% of cost

If you need more information or want to get a quote, then you can visit the website for yourself.

Insure My Equipment

Insuremyequipment.com does precisely what the name suggests. They are an online insurer for expensive equipment (like camera gear & golf clubs). You can use them to get specific pieces of gear insured but please bear in mind this policy is only for your specified gear.

An Insure My Equipment policy works well in combination with other travel insurance. Insure My Equipment policies are an excellent choice for professionals and backpackers with more $0000’s worth of camera equipment, expensive laptops or fishing rods.

I also know a few traveling musicians and DJs who use these guys so you are in cool company.

How To Choose The Right Malaysia Travel Insurance For You

Choosing the right travel insurance for your Malaysia holiday is like choosing a pair of shoes. Only you can really say how well they fit, and how many miles you can manage in them.

To decide who the right insurer for you is, you need to add up how much your trip is worth, how much equipment you plan to take with you and what activities you intend to engage in.

You also need to ask yourself how much you can afford. This means how much you can afford to pay for cover but also how much you can afford to be out of pocket in the unlikely event of an incident. Sometimes, the cheapest Malaysia travel insurance will be enough and sometimes it will be worth spending a bit more.

Hopefully the information provided in this post will help you to decide. If not, then I guess I just wasted 7 hours of my life in writing it.

Final Thoughts on Malaysia Travel Insurance

And there you have it; that’s Malaysia travel insurance in a nutshell! Hopefully, that’s cleared up any questions you had, and now you know what to expect. We guarantee that you will have a remarkable time in Malaysia. It’s one of those countries that has something for everyone, and all types of travelers will find reasons to love visiting Malaysia. Solo backpackers, families, groups, couples – everyone, really!

Before you dash off, we have heaps more Malaysia travel content for you to check out. Let us inspire you with our tips on where to go in Malaysia, what to do, what to see, where to stay – the whole works. Happy travels!

Buy Us a Coffee!

A couple of you lovely readers suggested we set up a tip jar for direct support as an alternative to booking through our links. So we created one!

You can now buy The Broke Backpacker a coffee. If you like and use our content to plan your trips, it’s a much appreciated way to show appreciation 🙂