The Broke Backpacker is supported by you. Clicking through our links may earn us a small affiliate commission, and that's what allows us to keep producing free content 🙂 Learn more.

Our big, beautiful world is truly vast and fascinating. Nothing can replace exploring and experiencing it first-hand and deciding to travel, was certainly one of the best decisions that I ever made. However, when we are preparing for a trip, it can be all too easy to get caught up in the excitement and forget about the boring, but seriously important little details such as checking that our passport is in date, and getting travel insurance.

But, not purchasing travel insurance can sometimes, sadly prove to be one of the biggest mistakes a person can make. No one is immune from unfortunate accidents when traveling the world and the worst can and does happen out there. I have personally had to claim on mine several times over the years and I never take a trip without it.

If you are reading this, then you probably already know why you need travel insurance so in this post we are simply going to help you try and find the best travel insurance for you.

The Broke Backpacker is supported by you. Clicking through our links may earn us a small affiliate commission, and that's what allows us to keep producing free content 🙂 Learn more.

Quick Answers – Are These The Best Travel Insurance Providers?

SafetyWing

- > Starts at $42 for 28 days

- > Primarily for medical expenses

- > Subscription-based payment system

World Nomads

- > 2 Plans available

- > Can cover over 140 countries

- > Easy to purchase and customize

HeyMondo

- > 24/7 worldwide assistance

- > streamlined app for easy claims

- > plans cover people from all over the world

Faye

- > Excellen value

- > Instant payouts via e-Wallet

- > Excellent customer service

Insure My Equipment

- > From $350/500 a year

- > Travel insurance for expensive equipment

- > Works with other cheap travel insurance

RentalCover.com

- > Only $7 – $20 a day!

- > Affordable & easy to claim

- > Cover any rental vehicle

Best Travel Insurance: Company Breakdowns

Choosing the best travel insurance for yourself is a matter of individual need. Each policy is different and will be more or less catered to different travelers. This in-depth review highlights some travel insurance companies that I personally used and will hopefully help you to make an informed choice regarding what type of insurance you need to cover your specific adventure.

Below I will break down the top travel insurance policies, what they cover, how much they cost, and everything else you need to know to be prepared for your next trip. I have organized each of the best travel insurance reviews by category to try and make finding the right cover for your unique, personal needs that little bit more easy and straightforward. For example, will you need medical evacuation coverage or gadget insurance?

Each company will be examined and broken down by the following details:

- General Overview of the travel insurance

- What may the travel insurance cover?

- What are the cons of travel insurance?

- How much does the travel insurance cost?

#1 SafetyWing– Excellent Medical Insurance for Travelers

SafetyWing is a budget, easy-to-use and overall good travel insurance that is meant to be used primarily for medical expenses. With affordable rates, a very convenient payment system, and some notable perks, SafetyWing is a great choice for those who need flexible medical insurance while traveling. It is cover intended for long term travelers who don’t really need much in the way of trip interruption or cancellation cover which makes it ideal for Digital Nomads, and slow travel budget backpackers.

SafetyWing uses a subscription-based payment system, wherein travelers pay for insurance on a monthly basis, as opposed to all at once in the beginning. This method of payment can be easier on a backpacker’s wallet, especially when you consider that rates can be as low $42/month.

Of special note is the fact that SafetyWing may even offer you some medical coverage in your home country! This means you can visit home for the holidays, a breather, a family reunion, whatever, and may still receive medical support. This sort of provider coverage is unheard of in travel insurance and makes SafetyWing really stand out from the rest. I can personally vouch for how user friendly Safety Wing are, the policy can be set up within minutes, cancelled just as easily and I found their online support to both fast and thorough in their responses.

Convenient monthly subscription model.

Can cover medical expenses when overseas.

Evacuation repatriation, and trip interruption.

Limited medical coverage in home country – 15 days out of 90 for Americans and 30 days out of 90 for everyone else.

Limited travel insurance perks stuff like baggage, disaster-relief, and travel delays.

No coverage for personal electronics e.g. computers, phones, cameras, etc.

How Much Does a SafetyWing Policy Cost?

SafetyWing can cost as little as $42 for 28 days! Compared to some private medical insurance policies, which can cost hundreds of dollars, SafetyWing has definitely earned its spot as a cheap travel insurance.

SafetyWing’s monthly premium varies depending on a set of factors, most notably the age of the applicant. You will also have higher premiums if you visit the USA (probably due to the shitty American healthcare system). Each quote is made on a case-by-case basis though, so we suggest that you go and make your own at the official SafetyWing website. We’d still consider SafetyWing to be one of the best holiday insurances as well as one of the cheapest.

In some cases, you will need to make a co-payment at treatment e.g. $50 when being admitted to Urgent Care. Be sure to consult the policy packet for more details on this.

Need help deciding between Safety Wing or Hey Mondo? Check out our helpful guide.

#2 World Nomads – The Travel Insurance for Backpackers

We’ll go ahead and save you some precious time and energy: World Nomads travel insurance has been designed by travelers for travelers, with coverage for more than 150 activities as well as emergency medical, lost luggage, trip cancellation and more.

World Nomads provides travel insurance in over 100 countries and if you leave home without travel insurance or your policy runs out, you can easily buy or extend while on the road – and that’s a big bonus!

World Nomads Travel Insurance Plans

World Nomads keeps it pretty simple. There are two plans to choose from: the Standard Plan and the Explorer Plan. Depending on your country of residence, age, and travel destination(s), the prices will vary accordingly.

For the full list of what is covered under each insurance plan click here.

How Much does World Nomads Travel Insurance Cost?

Good news! Each World Nomads insurance policy is customizable for each person. You can choose the exact dates and countries you want coverage for, and bam, you’re insured! Easy. Price is determined by your age, intended destination(s), length of trip, and what type of plan you go with.

#3 My Global Shield – Bargain Cover

My Global Shield is a travel insurance product that focuses on the specific needs of long-duration, frequent, and special-purpose international travelers.

My Global Shield provides insurance coverage tailored for international travelers, students, immigrants, and others. They offer a range of comprehensive options including visa traveler medical insurance, visa health insurance, visitors insurance, international travel medical insurance, trip insurance, and study abroad insurance??

Some specific coverage details include medical coverage for accidents or illnesses while outside one’s home country, travel coverage for travel delays, lost checked luggage, emergency response, natural disasters, and personal liability. The medical coverage extends to hospital room and board, intensive care unit costs up to the overall policy limit, and local ambulance services.

Their policy prices are very reasonable but in terms of downsides, they don’t seem to offer a multi-country “backpacker” cover at this time.

Competitive prices on cover

Plans available for short or long trips

COVID-19 coverage included

Serves travelers from most countries in the world

Some high risk activities not covered

How Much does My Global Shield Insurance Cost?

Prices vary depending on where you are going and when as well as the travellers age, health and all kind of factors. However My Global Shield do offer some good, competitive rates of cover including a 4 week premium cover that starts at $23.52.

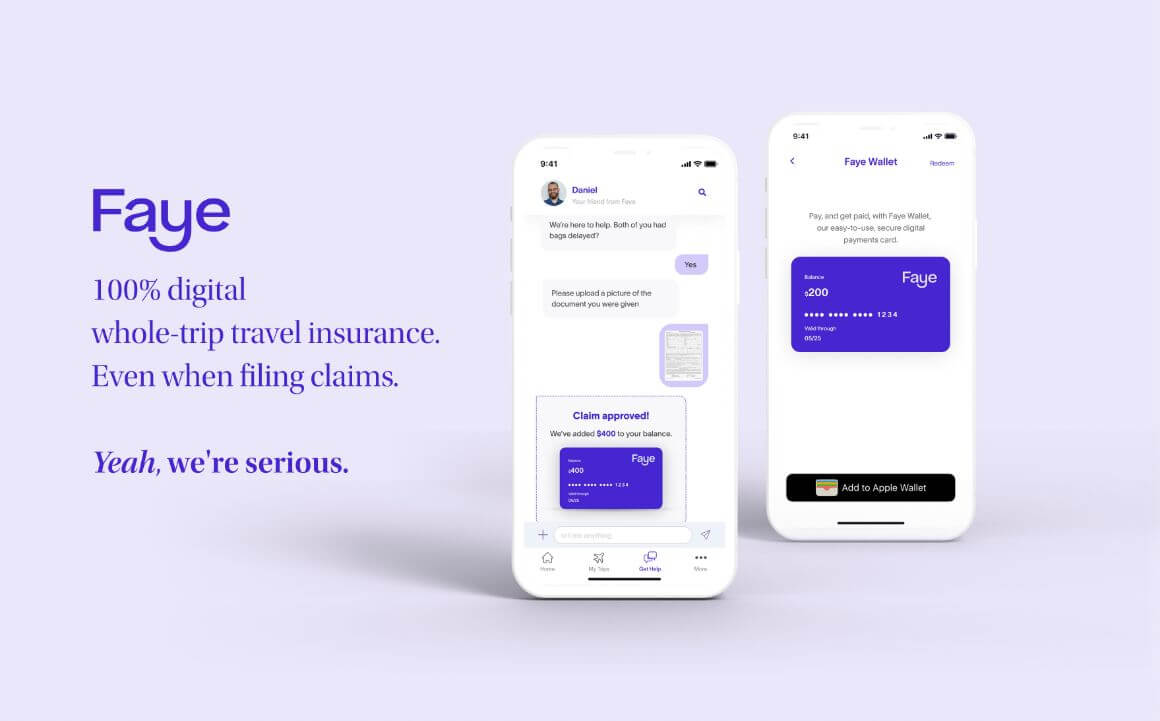

#4 Faye – The Next Generation of Travel Insurance

Faye Travel Insurance provides whole-trip travel coverage and care that brings out the best in each journey with industry-leading technology that enables smarter and smoother assistance with faster claims resolutions. Their app based travel insurance covers your health, your trip and your gear all via an app that provides real-time proactive solutions, quick reimbursements and 24/7 customer support.

If you ever do need to make a claim, then you simply log in to the app and the claim will be assessed super quickly from anywhere in the world!

Best of all, if the claim is successful then the funds will be immediately credited to the smart wallet on your phone or device and ready for you to spend.

In summary, we have tried and tested a lot of different insurance policies and we have never found anything one like this. The only downside we have found so far is that they can only offer cover to residents of 43 US States although there are plans to go nationwide in the future.

100% Digital Travel Insurance

Get a quote in 60 seconds

24/7 customer support

Quick claims processing – potential payouts within hours

Pre-existing condition & COVID-19 coverage included

.

Available in the US only

Not the cheapest provider

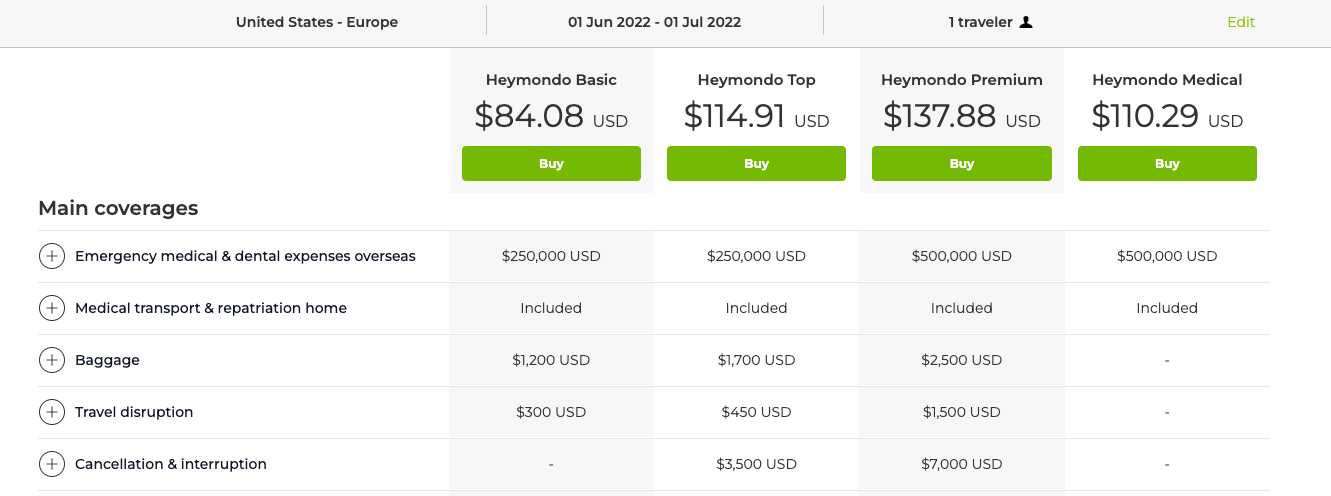

#5 Heymondo – Effective and Efficient

Heymondo are up-to-date when it comes to combining travel insurance with technology for a quick and easy experience. What truly sets them apart is their assistance app offering a 24-hour medical chat, free emergency assistance calls and incident management. How reassuring is that?! They also have a complication-free way to make a claim straight from your phone. No deductibles are also an added bonus.

Medical expenses are covered up to $10,000,000 USD so try not to damage yourself anything over that amount… If you’d like travel insurance that operates with that little extra swiftness and ease, give these guys a go.

24/7 help-line for medical chats, free emergency assistance calls and incident management

plans available for long, short-term and annual multi-trip travel

COVID-19 coverage included in each plan

Serves travelers from any country in the world

Baggage/personal property, travel disruption are NOT covered in the medical insurance plan

You’ll have to pay extra for more “extreme” activities such as white-water rafting, deep water sports, high altitude trekking, mountain biking, horse-riding etc…

How Much does Heymondo Travel Insurance Cost?

Each Heymondo insurance policy is customizable by date, countries you want coverage for, length of trip, and what type of plan you go with.

Here’s an example price quote for a person taking a 4-week trip to Europe from the USA.

There you have it. Heymondo offers coverage up to higher amounts compared to other insurance companies, but may be a little more expensive. It may not be the best for adventure activities, as you have to pay more for those, but overall, we find Heymondo to be great value for money with the premium plan being our top pick (you get a lot more for a little extra money).

The price above INCLUDES our exclusive 5% off pricing for Broke Backpacker readers.

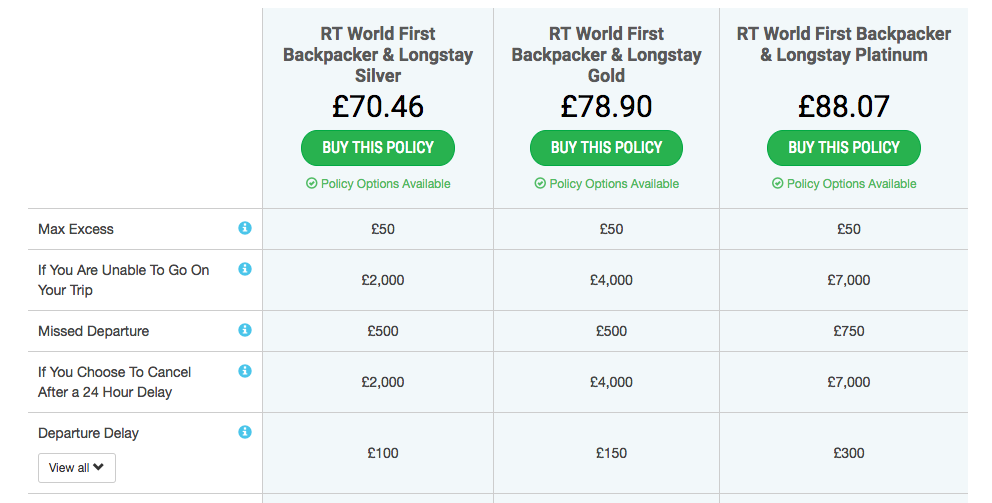

#6 World First – Good Cheap(ish) Travel Insurance

World First is provides excellent budget travel insurance for UK residents (and they only cover UK residents). Whether you are going on a short trip or a multi-month odyssey, World First offers a decent policy coverage starting at just a few bucks a day.

I appreciate how many different aspects of a trip they cover. Similar to World Nomads, World First offers coverage for a medical emergency, trip delay, lost or stolen cash and gear, legal advice, and dental treatment.

Image: Nic Hilditch-Short

As is the case with budget travel insurance, the coverage benefits are somewhat limited (and I will cover that in the cons).

If you are looking to buy cheap travel insurance to buy yourself some travel protection, or you just need to appease your mother by obtaining insurance, buying World First travel insurance is a great choice.

Sometimes the best travel insurance for you, is the cheapest travel insurance.

Can be tailored to your own needs, budget, and intended activities.

The “Platinum” policy option can cover personal belongings up to £4000.

Maximum excess charge is just £50.

Poor dental coverage.

The reimbursement in case of death is minimal.

Only available for UK residents. Sorry…

How Much Does A World First Insurance Policy Cost?

The example below is for a 2-month trip to the USA for someone 25 years of age.

For a little over £1.16 a day you can have decent travel insurance. That’s awesome! For what you get in return, World First is an excellent coverage option and certainly one of the best travel insurance providers for budget backpackers.

Once again, Travel Insurance Terms and Conditions do vary from time to time and depending on the individual. Make sure you read the policy T & C’s very carefully.

#7 Insure My Equipment – Best Travel Insurance for Covering Electronics

Insuremyequipment.com is a website providing comprehensive travel insurance for expensive equipment (like camera gear). You can get specific pieces of gear insured so you know exactly what will be covered. I have had separate cover for my MacBook for years now and was very glad that I had it when the Mother board blew back in 2018…

Ok so an Insure My Equipment policy works well in combination with another cheap travel insurance that covers medical expenses. That way you can have the best of both worlds; Completely protect your expensive electronics as well as yourself.

Insure My Equipment policies are excellent for professionals and backpackers with more than $3000-$4000 worth of camera equipment.

Offers the option to insure equipment that is rented or owned For owned equipment, there is a $750,000 maxlimit.

Easy to set up and clear about what is covered.

Good customer feedback.

No medical or trip protection benefits.

Not ideal for the average backpacker: Insure My Equipment specialize in protecting high-end gear.

How Much Does an Insure My Equipment Policy Cost?

Each policy offered by Insure My Equipment is tailored to the items and coverage you need.

The best way to find out travel insurance prices for your gear is to build a custom quote on their website. That way, you can find out what the insurance costs are in relation to your own equipment.

For insuring several high-end cameras lenses, a laptop, and other electronic bits, you are looking at between $350/500 a year.

Remember, Travel Insurance Terms and Conditions do vary from time to time and depending on the individual. Make sure you read the policy T & C’s very carefully.

#8 RentalCover.com – Vehicle Insurance for Travelers

Ever had a small accident on the road that turned into an expensive and nightmarish holiday? So have we. We know the pain of interrupting your travels to deal with your rental company, the repair mechanics, and your bank all at once whilst staying in a dodgy motel because you’re stuck in the middle of nowhere. There goes your holiday (sigh).

That’s why if you plan on renting a vehicle, we suggest you arm yourself with car rental insurance for your travels! You’ll avoid being stuck in a very unpleasant situation and will not only save time but also heaps of money, and most importantly, frustration.

Our top pick for rental car insurance for travel is RentalCover.com. Heard of them before? They’re super affordable and easy to purchase and claim from – what you see is what you get, so you can sit back and relax knowing that they’ve got your back.

RentalCover.com is a global independent rental insurance provider that may be able to cover any rental vehicle (cars, 4x4s, motorhomes, minibuses, etc.) from any rental company, anywhere around the world. That’s not all. On top of this, RentalCover.com may be able to cover everything excluded by rental companies. This includes, but isn’t limited to:

All these benefits make RentalCover.com our top pick for car insurance for backpackers on the market.

Policies around $10 – $15 a day.

Valid claims usually paid within 3 business days.

Policies all have zero excess. If you’re in trouble, they refund you – end of the story.

Customizable policies to cater to every traveler.

Unfortunately, some rental companies don’t yet recognize them and insist you buy THEIR cover.

Only insures the car, not you and not the rest of your trip.

How Much Does RentalCover.com Policy Cost?

RentalCover.com policies cost only $7 – $20 a day on average depending on the destination, the vehicle type, and the driver’s age. Their price is a lot cheaper than the ones we’ve seen at the rental desk, which usually charge you around $15 – $30 a day. Also, as everything’s covered, you’ll get every penny back on what you’ve spent on repairs.

Policies around $17-$22 a day for premium

You can qualify for coverage of pre-existing medical conditions if you buy the policy prior to or within 24 hours of making your final trip payment.

Interruption coverage of up to 175% of your trip costs (Premium)

High level of baggage loss coverage at $2,000 per person (Premium)

They are one of the more expensive providers on the market.

Only their premium policy offers coverage for pre-existing conditions

More of the Best Travel Insurances

We’ve gone over all of the main travel insurance companies of 2022 already, but there are a few more unique ones that need to be mentioned as well. For a more specific travel insurance, choose from these ones:

#9 Insure My Trip – Travel Insurance for Older Travelers

For travelers over 65 years of age, Insure My Trip is one of the travel insurance companies on the market. Their website allows you to compare quotes and prices from various policies so that you can easily find the one that works for you. If for some reason you are unhappy with a plan you have purchased, you may be able to get a refund.

Overall, consider a specialized senior travel insurance to enjoy your travels fully.

#10 Columbus Direct Insurance – Travel Insurance for Ozzies and Kiwis

These guys offer some kickass deals on backpacker travel insurance for residents of the UK. If you have a pre-existing medical condition, be sure to read the terms and conditions thoroughly before taking up the insurance.

#11 Gadget Cover – Electronics Travel Insurance for UK Residents

Well, that didn’t last long. We’re back with another UK-specific travel insurance specifically for protecting your gadgets and electronics. Cover your pricey and precious electronics while on the road. Particularly suited for people who take numerous trips per year, returning to the UK often. Gadget Cover’s Total Transparency Manifesto makes understanding their policies plain and simple.

Why Do You Even Need Travel Insurance?

To us travelling with a proper insurance seems like a no-brainer, but we had to learn the hard way as well. You might be thinking:

- Why do I even need travel insurance?

- Am I wasting my time thinking about travel insurance?

- Is it important anyway?

- Where did I leave my goddamn keys?

We can answer three of those questions.

Let’s be honest. None of us wants to pay for travel insurance. That said, nobody wants to lose a ton of money in general… and that can easily happen when you are on any given backpacking adventure.

Buying travel insurance is an investment and a safety net to guard against the unplanned craziness of traveling. Maybe you won’t use it on your first trip, or your second, or third, but you will eventually need it, and you’ll want to be ready.

Whilst hunting for the best travel insurance can be a pain in the ass, don’t worry, we have done all of the hard work for you (including learning lessons the hard way).

Things that happened to The Broke Backpacker team on the road…

- My backpack was stolen with all worldly possessions inside.

- Needed stitches in the head after crashing a motorbike in Thailand.

- Strikes in Bucharest meant getting stuck in traffic for hours and missing a flight.

- Spending two weeks in a hospital in Costa Rica after nearly dying in the jungle.

- Needed to go on an IV in Pakistan after being sick for days.

- Dengue fever in Thailand and grounded for a week in a clinic; there was no hospital nearby.

We want to point out that this all happened over nearly a decade of traveling the world. Most of the time, when you travel, nothing goes wrong. But it only takes one poor decision, a misjudged bend in the road, one sneaky-bastard thief, or plain bad luck to change everything.

A question we often get asked is whether you can buy travel insurance after departure. The answer is yes!

Drink water from ANYWHERE. The Grayl Geopress is the worlds leading filtered water bottle protecting you from all manner of waterborne nasties.

Single-use plastic bottles are a MASSIVE threat to marine life. Be a part of the solution and travel with a filter water bottle. Save money and the environment!

We’ve tested the Geopress rigorously from the icy heights of Pakistan to the tropical jungles of Bali, and can confirm: it’s the best water bottle you’ll ever buy!

View on REI Read the ReviewWhat Makes a Good Travel Insurance Policy?

When trying to decide what the best travel insurance company is for you, you need to first assess your own needs. Every type of trip and traveler requires a different level of travel insurance. What may be the best travel insurance for you might not be best for the next person.

You’ll need to start asking some questions about your planned destination and what you may be doing whilst your backpacking there.

- Do you have high-end electronics you need to protect?

- Are you traveling to a dangerous country with the potential for civil unrest, political strife, or armed conflict?

- Do you plan on undertaking risky activities abroad like skiing, mountaineering, or rock climbing?

- Are you traveling long-term and just need basic protection?

Once all of these questions are answered, you can start looking for the right travel insurance for your travel needs. And let us tell you, simply going for the cheapest one might not cut it for everyone…

Travel Insurance and COVID

When COVID-19 first rocked the world in 2020, most travel insurers were quick to invoke their cancellation clauses and pull all cover relating to either illness, cancellation or disruption caused by the pesky pandemic.

These days, most insurance providers are offering some form of COVID insurance coverage included within their policies, but some are more useful than others. Whilst many now cover hospitalisation caused by COVID infections, fewer are offering any kind of cover for disruption or cancellation such as being refused boarding on a flight for displaying symptoms, or having to cancel your trip because of a positive test.

Whilst the pandemic has largely subsided, COVID is still able to severely disrupt travel plans. Therefore do consider paying close attention to the finer details of any insurers COVID-19 cover.

Top Tips for Buying and Using Travel Insurance

There are some tips and tricks when purchasing a travel insurance. To make sure that you won’t have to go through all the hassle we went through, we’ve listed our insider knowledge below.

How to Make a Claim on your Travel Insurance Policy

This is the best piece of advice we can give you: if you need to make a claim, get all your documents in order as soon as possible.

If you have been robbed you will need a police report. In general, getting a police report tends to vastly speed up payment on your claim. Most insurance companies require a report.

Keeping receipts of all the valuables you take traveling is a really good idea – the insurance company will want to see that you actually bought the items in the first place before they payout.

You need to be patient when it comes to actually getting paid as even the best insurance companies sometimes drag their feet. If the first offer that the travel insurance company makes you is ridiculously low then dispute it – the second offer is usually a lot better.

Point being, the more documentation you have regarding the items you are traveling with, the better. It’s not a bad idea to have a date-marked picture of all of your stuff before setting off on a trip.

If you do have expensive electronics, register the items with the company. That way, you can easily look up the exact model you had before you broke/lost it. If registering the equipment isn’t an option, write down the serial numbers or barcodes and stash that information somewhere safe. Jotting down the serial numbers of your phone, laptop, and camera might seem tedious and a bit overkill, but you should only have to do it once. If the time comes when you actually need that information on hand, you’ll sure be happy to have it.

Declaring Pre-Existing Conditions

First off, read all of the fine print of any travel insurance policy you buy. Almost all insurance companies will not issue payment for medical treatment you receive as a result of a pre-existing condition. If you have a pre-existing medical condition, then you should seek out recommended travel insurance that will cover you with full knowledge of that condition.

If you make a claim with a travel insurance company and they uncover your medical history (which they inevitably will), they will most-likely declare your insurance void and you will be stuck with the bill.

Insurance companies will usually do anything to avoid paying you. Having a secret pre-existing medical condition that you fail to report is a sure way to get your policy nullified. Be honest. Read the fine print. Do your homework on what is covered and what is not (especially with regard to pre-existing conditions).

Do everything in your power to ensure you get paid by the insurance company when you need to be.

FAQ about the Best Travel Insurance

Still have some questions? No problem! We’ve listed and answered the most commonly asked questions below. Here’s what people usually want to know:

Final Thoughts on the Best Travel Insurance

Shopping reviews for the best travel insurance is nobody’s idea of a good time. That said, it does pay to research prices and policies and find the right company that will cover all of your needs whilst not breaking the bank.

Travel insurance is just one of those things that we would never travel without. Whichever company you end up traveling with, get to know the policy intimately. Read it yourself very carefully. We can’t emphasize that enough! The more you know your insurance policy, the more you will know about how and when to use it. Make sure you read the policy T & C’s very carefully.

As I have said before, my favorite go-to travel insurance is World Nomads. They are affordable and may be able to insure backpackers for 100+ countries. For many travelers, World Nomads is a great company to go with.

We sincerely hope that you stay safe whilst having amazing adventures over the course of your traveling career! Happy travels… see you down the road. If you’re insured.

World Nomads provides travel insurance for travelers in over 100 countries. As an affiliate, we receive a fee when you get a quote from World Nomads using this link. We do not represent World Nomads. This is information only and not a recommendation to buy travel insurance.

Buy Us a Coffee!

A couple of you lovely readers suggested we set up a tip jar for direct support as an alternative to booking through our links, since we’ve decided to keep the site ad-free. So here it is!

You can now buy The Broke Backpacker a coffee. If you like and use our content to plan your trips, it’s a much appreciated way to show appreciation 🙂