Embracing the call of adventure is a wild roller-coaster demanding a good chunk of courage and a just bit of recklessness. But let’s not forget, travel is not all sunsets and road trips, the real adventurer embraces the entirety of the journey, those all. too certain uncertainties included.

Yep, the road less travelled does indeed often come with its share of bumps. Danger lurks in unexpected places, from treacherous trails to bustling city streets. What happens when a simple injury turns into a critical emergency, miles away from home and sometimes miles away from anywhere!? Many shove these thoughts aside, thinking, “it won’t happen to me,” but the reality is, it can happen and it does happen.

That’s where travel medical evacuation insurance steps in. Getting good travel medical evacuation insurance can be a game-changer that helps to ensure that a mishap doesn’t turn into a financial disaster. In this post, I’ll dive into why investing in medical evacuation insurance could be one of the smartest travel decisions you make, guiding you to travel smarter, safer, and with peace of mind. I will share my years of lost bags, bruised shins and runny-bummies to help you find what you need.

Photo: @amandaadraper

The Broke Backpacker is supported by you. Clicking through our links may earn us a small affiliate commission, and that's what allows us to keep producing free content 🙂 Learn more.

- Why You Need Medical Evacuation Insurance

- What Does Medical Evacuation Insurance Cover?

- Does Travel Insurance Include Medical Evacuation Insurance?

- How to Choose the Best Medical Evacuation Insurance

- Alternatives to Standalone Medical Evacuation Insurance

- Final Thoughts on Best Medical Evacuation Insurance

- Buy Us a Coffee!

Why You Need Medical Evacuation Insurance

You might be asking yourself, do I need travel insurance that covers medical insurance?

Imagine trekking through the high altitudes of Nepal (The Annapurna Trek is highly recommended), and suddenly, you face a medical emergency such as coming down with Malaria or breaking a bone. Well, I am sure you can appreciate that the costs and logistics of arranging an emergency evacuation from a remote mountainside can be absolutely staggering.

Recently, a backpacker we know was in Peru and suffered a severe injury and, thanks to their medical evacuation insurance, was promptly airlifted to a nearby hospital, saving both time and thousands of dollars. Without insurance? Such evacuations can easily range from $20,000 to upwards of $100,000. Not many broke backpackers could ever afford to repay that, right? So why risk financial strain when the unpredictable strikes?

What Does Medical Evacuation Insurance Cover?

Ok, so medical evacuation insurance typically covers:

- Air Ambulance Services: Emergency airlifts to the nearest suitable hospital.

- Ground Ambulance Services: Transportation via land to medical facilities.

- Return of Mortal Remains: In the unfortunate event of death, the costs of repatriation of remains will be covered.

- Transportation Back Home Post-Recovery: Ensuring you get back home safely post-medical treatment.

However, it is said that every silver lining has its cloud. Some medical evacuation insurance policies might exclude specific regions, or specific activities that are considered high-risk (such as minefield soccer!). Therefore, always double-check the details, especially if you’ve opted for cheap backpacker insurance. If your destination or activity is exempt, then cancel the policy and find one elsewhere. You will almost ALWAYS be able to find the right cover you need even if you have to pay a hefty premium for it.

Remember, even the best travel insurance doesn’t always cover what you might specifically need it for.

Image: Nic Hilditch-Short

Does Travel Insurance Include Medical Evacuation Insurance?

Navigating the intricate world of travel insurance can feel like walking through a maze blindfolded. Take it from me, I have studied loads of different travel insurance policies over the years.

One of the biggest questions that pop up is, “Does my travel insurance include medical evacuation coverage?” Well, fellow travellers, unfortunately, it’s not a straightforward ‘yes’ or ‘no’ answer.

While many comprehensive travel insurance policies do throw in medical evacuation as part of the package, it’s not actually a given across the board. You’ll find policies out there that treat medical evacuation like the extra guacamole in your burrito – nice to have, but it’s going to cost you.

The coverage limits can vary wildly, from a paltry $50,000 to a robust $1 million, leaving you with a crucial question: Is it going to be enough? The cost of medical evacuation can skyrocket faster than a jet plane (see what we did there?), and if you’re stranded in a remote location, you’re going to want the kind of coverage that ensures you’re whisked away to safety, quickly, and without a second thought about the price tag (helicopters don’t have metres do they?).

So, don’t just tick off the travel insurance box and call it a day. Instead, take some time to dig deep, read the fine print, and make sure that your policy is more than just a flimsy umbrella in a hurricane – because when it comes to medical evacuation, you wanna be inside of a fortress.

Always make sure you’re clear on what your insurance covers before you take out the policy!

How to Choose the Best Medical Evacuation Insurance

There is no single ‘best’ Medical Evacuation Insurance provider and even if there were, strict regulations around providing financial advice would prevent me from saying so! Rather it is a matter of finding the best medical evacuation Insurance for you and your needs, from one trip to the next.

Here’s what to consider when choosing Medical Evacuation Insurance:

- Destination Specifics: Are you going trekking in remote or dangerous areas? Then you might need more specialised and enhanced coverage.

- Duration and Frequency of Travel: Long-term, or open, travel may require different policy considerations.

- Personal Health Considerations: Pre-existing conditions could influence your policy needs. If you need to be evacuated because of a flare-up of a pre-existing condition your insurer may pull cover.

- Policy Costs and Deductibles: You WILL have to pay something out of your own pocket, the trick is to balance the trade-off between premiums/ excess and these out-of-pocket costs.

- Fine Print: Ensure you know what’s excluded and the limitations of your coverage.

How Much Does Medical Evacuation Insurance Cost?

The average cost of medical evacuation insurance depends on various factors, from your destination to the length of coverage. Insurance policy pricing is complex and computations take in a whole myriad of factors and tend to change and fluctuate in real time.

Typically though, you can expect to pay anywhere from $50 to $500+ for any travel insurance coverage.

Photo: @joemiddlehurst

Alternatives to Standalone Medical Evacuation Insurance

Many travellers simply opt for comprehensive travel insurance that includes medical evacuation. This bundled approach can be time and cost-effective and ensures broad coverage. However, if you go down this route do ensure the medical evacuation component is robust and not just a secondary add-on.

Personally, I have never felt the need to take out independent, standalone Medical Evacuation Insurance and have always felt comfortably covered with my ‘standard’ travel insurance. This includes trips to the jungles of Venezuela and the mountains of Pakistan.

Below, are some travel insurance providers who I have used, and all of whom provide medical evac insurance.

World Nomads

World Nomads have been insuring backpackers for years now. World Nomads specialise in providing backpacker travel insurance and their policies cover long-way travel on one-way tickets, trips to multiple countries and a whole lot of adventure activities.

These guys are well used to dealing with backpackers like us, and they are regularly recommended by travel bloggers and industry insiders. We love them.

They offer 2 different policies depending on your needs. The Standard Plan is standard & the Explorer Plan covers a whole host of high-risk, high-fun activities. World Nomads are also one of the few travel insurers who will write you a policy after starting your trip. The one downside for us is that they don’t cover Pakistan.

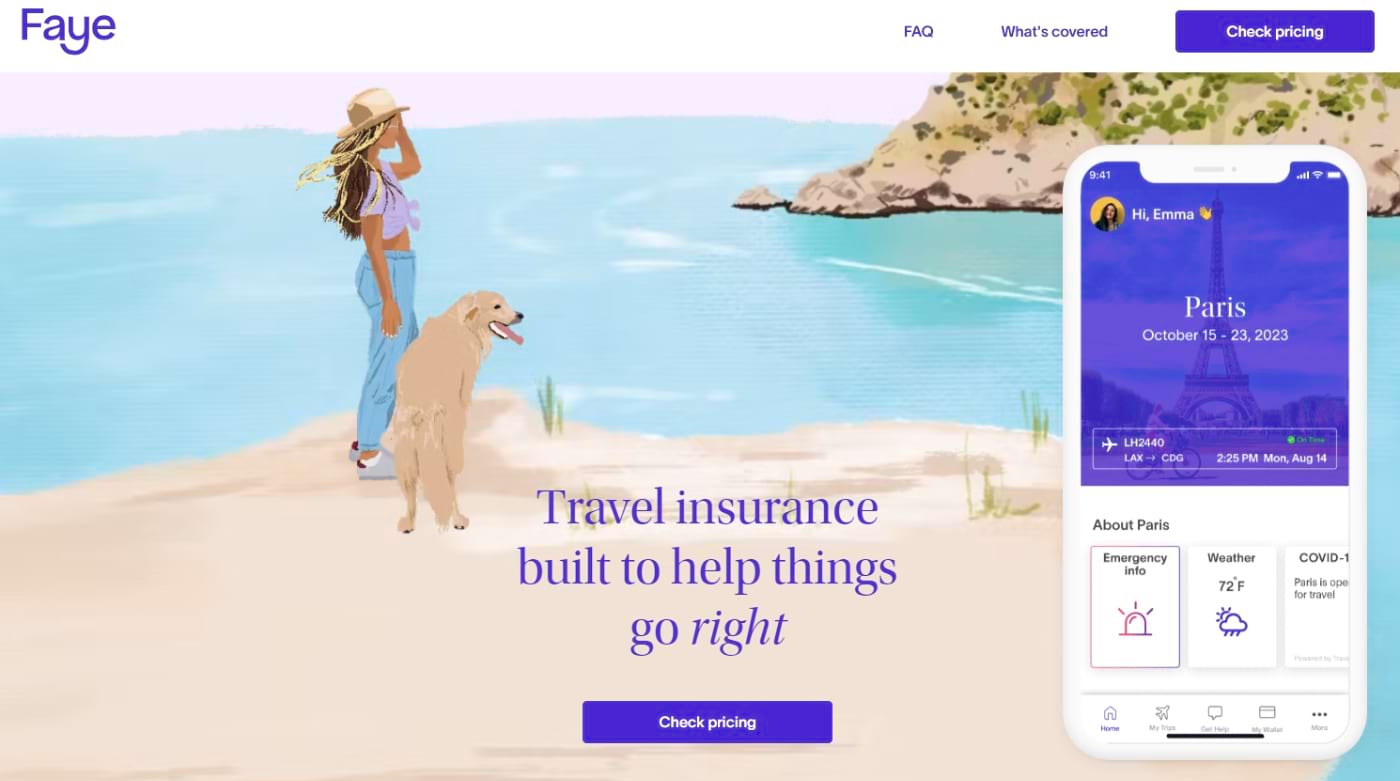

Faye

Faye is a US-based, fin-tech-travel-insurer whose industry-leading innovative platform was created to be efficient and user-friendly by placing an emphasis on resolving claims fast. Users can buy and manage their Faye policy without the need for any paperwork whatsoever by downloading the Faye app.

The app allows them to interact with Faye in real-time, and successful claims are paid out almost instantly to travellers’ e-wallets. It’s this that really makes us love Faye Insurance!

We’ve written a comprehensive guide to Faye travel insurance if you’re interested in learning more about this super modern provider.

Heymondo

Talk about efficient and effective, Heymondo are up-to-date when it comes to combining travel insurance with technology in the digital world of 2025.

What truly sets them apart is their assistance app which offers a 24-hour medical chat, free emergency assistance calls and incident management. How reassuring is that?! They also have a convenient and complication-free way to make a claim straight from your phone.

Medical expenses are covered up to $10,000,000 USD so try not to damage yourself anything over that amount! If you’d like travel insurance that operates with that little extra swiftness and ease, give these guys a go.

They offer multiple options – single trip, annual multi-trip and long stay. We’ve focused on a single trip, but do check out the others and find what fits your next adventure.

Visitors Coverage

VisitorsCoverage is an insurtech company primarily known for providing travel insurance solutions for international travellers. Founded in 2006 and headquartered in Santa Clara, California, the company offers a broad range of travel insurance policies catering to various needs, from trip cancellation to medical emergencies.

What makes Visitors Coverage a cracking choice is that they offer a Safe Cruise policy which is custom-made for cruise travellers. This is super important because those wanting to take a cruise will need a different and specific type of cover.

Columbus Direct

Named after one of history’s greatest (and most divisive explorers), Columbus Direct also specialise in insuring adventure-hungry explorers like us. They have been providing award-winning insurance for 30 years, so they’re no newcomers to the game!

What we like about this plan is that it does cover small amounts of personal cash. However, gadget cover is not available. Columbus Direct actually offers a number of different travel insurance plans, so you can pick the one that suits you best.

Photo: @rizwaandharsey

Final Thoughts on Best Medical Evacuation Insurance

In the vast mosaic of travel experiences, it’s easy to forget the importance of security nets like medical evacuation insurance. But if that time comes, you need to be sure you’ve got the cover you need!

As a broke backpacker myself, I fully understand the temptation to save a few bucks by cutting a few corners on a financial product that you will most probably (and hopefully) never actually need. But in the world of travel, your health and safety are priceless so don’t compromise on them.

Safe travels and see you on the road!

Buy Us a Coffee!

A couple of you lovely readers suggested we set up a tip jar for direct support as an alternative to booking through our links. So we created one!

You can now buy The Broke Backpacker a coffee. If you like and use our content to plan your trips, it’s a much appreciated way to show appreciation 🙂