If you’re planning a trip to the Netherlands, you’re in for a treat! This tiny nation is home to one of Europe’s coolest cities and some spectacular countryside, as well as some of the friendliest people in Europe. You can easily spend endless days winding along rural routes by bike, wandering around snapping pictures of windmills and smelling the tulips, or chilling in one of Amsterdam’s famous coffee shops and partying until late.

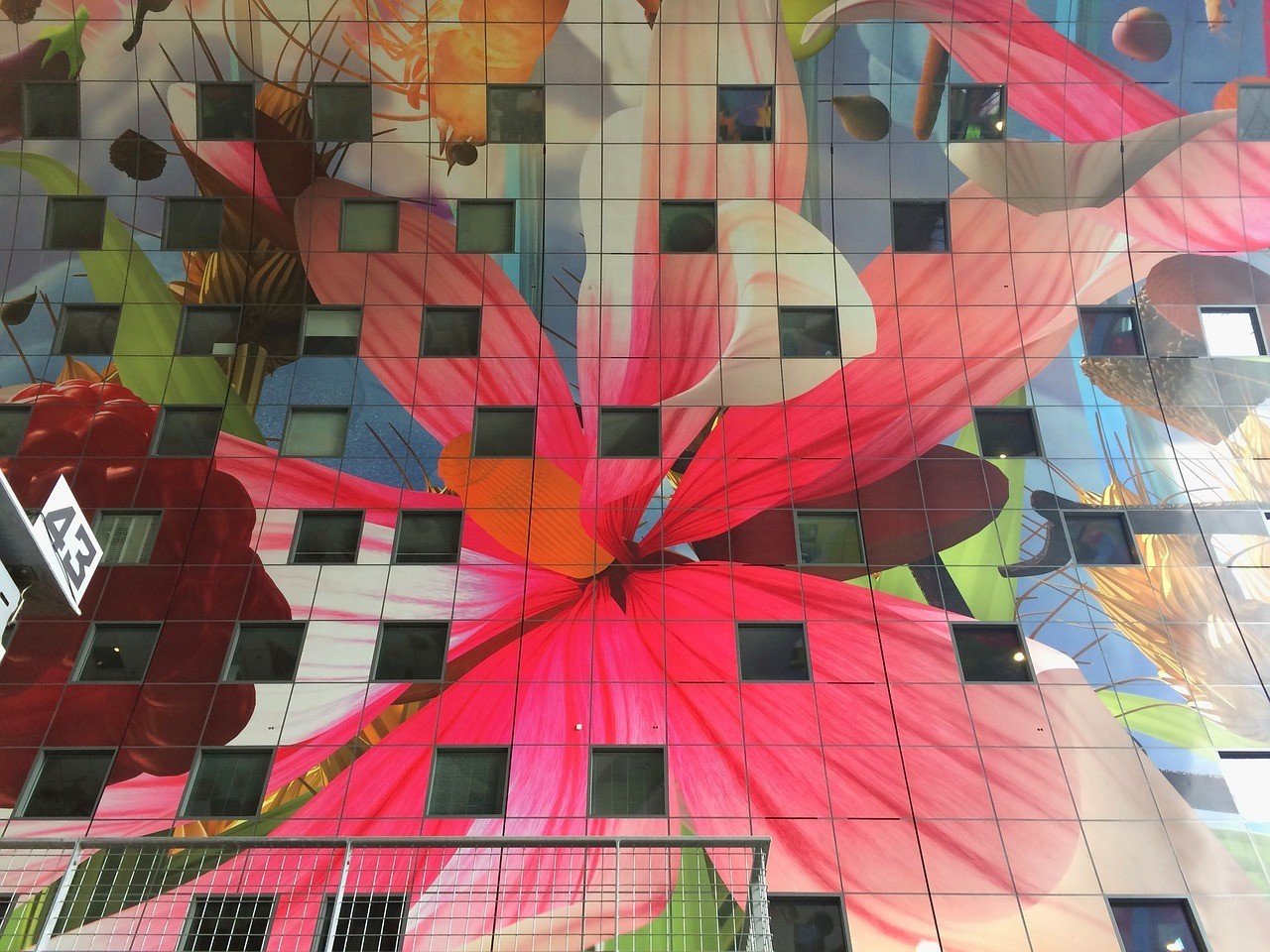

As we always say, there’s so much more to this Western European treasure than Amsterdam. We love this buzzing city, but we urge all visitors to get out and explore as much of the nation as you can! It’s a fabulous country to ease yourself into backpacking around Europe – or simply for a long weekend.

But before you start planning your itinerary around this awesome country, you have one thing to consider: that would be… travel insurance in the Netherlands!

Month to month payments, no lock-in contracts, and no itineraries required: that’s the exact kind of insurance digital nomads and long-term traveller types need. Cover yo’ pretty little self while you live the DREAM!

Visit SafetyWingDo I Need Travel Insurance For The Netherlands?

The Broke Backpacker is supported by you. Clicking through our links may earn us a small affiliate commission, and that's what allows us to keep producing free content 🙂 Learn more.

You may well need travel insurance for Holland. Depending on where you’re from, you may need to show proof of insurance. before you can enter. Travel insurance for visitors to the Netherlands is mandatory for all those who require a Schengen visa. Find out if your home country is on the Schengen Visa needed list here. If you are eligible to travel in the Netherlands without a visa or as part of the Schengen free movement agreement, then Dutch travel insurance isn’t mandatory.

So, if you’re not legally required to buy Netherlands travel insurance, why bother? The Netherlands is safe, right? There are no poisonous snakes, no tropical diseases – surely it’s too flat for skiing? Indeed, the Netherlands is remarkably safe. However, if you’re spending most of your time seeing the sights in Amsterdam you’re more likely to run into some trouble. Pick-pocketing, theft and drug-related crimes are pretty common in Amsterdam. You may not know it, but, due to its geography, the Netherlands is vulnerable to the effects of rising sea levels. It’s unlikely to cause a problem, but it’s worth thinking about travel insurance in the Netherlands in a worst-case scenario.

Ultimately, the choice is yours, although we always recommend erring on the side of caution. At least explore your options and consider even the cheapest the Netherlands travel insurance for peace of mind.

Need more convincing? Check out these other reasons why you should have travel insurance!

Unlock Our GREATEST Travel Secrets!

Sign up for our newsletter and get the best travel tips delivered right to your inbox.

Healthcare in The Netherlands

The Dutch healthcare service frequency tops medical charts both across Europe and worldwide. Most recently, the WHO placed healthcare in the Netherlands at #17. The 2018 Euro Health Consumer Index ranked it at #2. Medical services are efficient, clean and professional. Most doctors speak English, which is handy. Healthcare expenditure in the Netherlands is high. In 2016, the Dutch spent 10.3% of GDP on healthcare – that’s the 8th highest out of EU/EFTA.

The Netherlands operates a universal healthcare service. It’s managed by the government and supplemented by the private insurance sector. Most Dutch hospitals are privately run and split into three types – general hospitals, university hospitals and teaching hospitals. All adults 18+ must have basic medical insurance; that applies to foreigners living and working in the country as well. Those employed by a Dutch company will receive a small percentage of support from their employer.

If you do need to see a doctor while in the Netherlands, medical service is very accessible. In the case of an emergency, call 112 (it’s free), and the advisor will determine whether or not you need an ambulance. In non-emergency instances, you must first be seen by a huisarts (GP), who will then refer you to a specialist. It’s worth noting that Dutch doctors have a reputation for believing that paracetamol cures all, so don’t get too hopeful about antibiotics.

You will not be covered under Dutch medical insurance and will be expected to pay directly or via your travel insurance in the Netherlands. From the EU, EEA, or Switzerland? Snap yourself up a free European Health Insurance Card (EHIC). This makes you eligible for reduced cost or even free emergency treatment. But don’t go crashing your bike just so you can sample the famous Dutch healthcare.

Crime in The Netherlands

The Netherlands wears its reputation for being one of the safest countries in Europe with pride. Dutch people report feeling safe in their country. That covers using public transport and when out and about at night. However, as is the case in most cases, women feel warier of walking alone at night. In recent years, cybercrimes have seen a marginal increase in the Netherlands. Take care to protect yourself with a VPN when browsing the web over unsecured wi-fi networks to combat hackers. Check your Netherlands’ travel insurance policies against cybercrime.

In other news, there have been sharp drops in the levels of property crime, vandalism, and violent crimes. In 2019, only 14% of the Dutch population surveyed reported falling victim to one of these traditional types of crime. As a tourist, property crimes (pickpocketing and bike theft!) are what you’ll need to watch out for. Consider the best travel insurance for the Netherlands to protect against any loss of valuables you’re travelling with. If you are wandering around the Red Light District at night (no judgement here!), take extra precaution against pickpockets.

We all know the Dutch have a tolerant approach to drugs. But you need to get your head around what is and isn’t allowed. Cannabis is decriminalised, but it isn’t technically legal, either. Make sure you don’t carry more than five grams of hash on your person, and you’ll be fine and dandy. Magic mushrooms are illegal, but ‘truffles’ get the green light, within reason. Selling drugs is a major breach of Dutch drugs policy, and your Amsterdam travel insurance won’t help you if you’re caught selling or buying on the street.

Issues Facing Travellers in The Netherlands

Those lucky travellers who are exploring the Netherlands don’t have too much to worry about. One thing to be mindful of is that tour operators and airlines are always at risk of cancelling arrangements. Companies can liquidise overnight, and flights can be grounded due to inclement weather. Earlier this year, Storm Ciara battered The Netherlands with gale force 11 winds and lead to around 500 flights being canceled. You might want to storm-proof your holidays to the Netherlands with some insurance!

Theft is something to be cautious of in the Netherlands. We’ve touched on pickpocketing, but bicycle theft is actually the most common crime in Amsterdam. Over 8,000 bikes were reported as stolen in 2019. As a tourist, you’re very likely to want to hire your own two-wheeler to discover this vibrant city. Theft from cars is the second most common crime, with 4,562 cases reported last year. So whether you hire a bike or a car, consider protecting your goods.

As the Netherlands’ popularity continues to soar, the tourism boom is impacting this terrific destination. Compare Amsterdam’s modest population of 1.1 million with the 17 million tourists who descend on it each year. Do your best to be the conscientious traveller you know you are, and you won’t run into any problems!

Common Activities in The Netherlands

Most visitors to the Netherlands come for cultural immersion, windmills, ‘coffee,’ and oh so pretty tulips. What’s the worst that could happen? Besides that, there are a couple of activities in the region where you might want to think about covering your back with some Netherlands travel insurance.

- Bicycle Rental – you can’t visit the Netherlands and not hire a bike! But before you do, make sure that you have the best insurance for the Netherlands to cover your rented two-wheeler in case someone runs off with it while you’re gorging on Hollandse nieuwe.

- Car rental – check whether a rented vehicle is covered under your Netherlands travel insurance for any damage inflicted by you or a third party. Plus, don’t forget your valuables! If you’re not covered, the car rental service will provide it, but usually, their fees are on the steep side.

- Festivals – including floral parades, the world’s only floating gay parade, and a troupe of musical extravaganzas, the Netherlands caters for the lot! Again, this one is a case of covering your valuables in case a fellow reveller sets their sights on your new iPhone. If you are coming for a festival, book your Amsterdam hostel in advance as they can fill up.

Things go wrong on the road ALL THE TIME. Be prepared for what life throws at you.

Buy an AMK Travel Medical Kit before you head out on your next adventure – don’t be daft!

Buy on REIWhat Should Travel Insurance in The Netherlands Cover?

As a rule, most Netherlands travel insurance will include the following;

- Emergency Accident & Sickness Medical Expenses

- Baggage and Personal Property

- Emergency Evacuation and Repatriation

- Non-Medical Emergency Evacuation

- Trip Cancellation

- Trip Interruption

These are key terms to look out for when comparing insurance policies. Let’s take a closer look at what each one of these actually means.

Emergency Accident & Sickness Medical Expenses

The headline for most travel insurance policies is emergency medical costs. If you are in a car crash or come down with meningitis, you want to rest easy knowing that any ensuing medical costs will be taken care of.

In case you have never seen a medical bill, let us assure you that they can be expensive. A friend of mine once racked up costs of $10,000 in Costa Rica and then a nasty infection in Thailand cost him $2,000.00 for just 2 days in hospital. Ouch.

Pre-existing medical and health conditions may not be covered or may come at an additional premium.

Ideally, Emergency Accident & Sickness Medical insurance should offer at least $100,000.00 of coverage.

Baggage and Personal Property

Baggage and Personal Stuff coverage covers the value of your personal property. It’s most common application is for lost luggage and. Many policies also extend this to cover “on the ground” theft.

The limits on this vary between policies but rarely exceed $1000 with a maximum item value between usually up to $500.

This is fine for many travellers but if you travel with a lot of electrical gear (laptop & camera), you may also wish to think about taking out a separate gadget cover.

We’ve tested countless backpacks over the years, but there’s one that has always been the best and remains the best buy for adventurers: the broke backpacker-approved Osprey Aether and Ariel series.

Want more deetz on why these packs are so damn perfect? Then read our comprehensive review for the inside scoop!

View on Osprey View on REIEmergency Evacuation and Repatriation

Emergency evacuation covers the cost of sending you back to your home country in a sickbed. Let’s say that the above mentioned car crash is a nasty one and the decision is taken to send you home for further treatment; this will take care of the high, associated costs.

Repatriation is the cost of sending your earthly remains home in the tragic event you die overseas. The costs of this are generally huge, and it is not a burden I would want to leave to my family. Whilst this is rare, every now and then I do come across a Facebook or “Go Fund Me” page for somebody’s body to be flown home.

Non-Medical Emergency Evacuation

Non-medical Emergency Evacuation is when you have to be evacuated from your destination because of some unexpected crisis. Classic examples are outbreaks of war/civil unrest and earthquakes that decimate infrastructure. In recent times, the Corona COVID-19 outbreak created the biggest international emergency evacuation situation ever. (FYI – it straddled both the medical and non-medical evacuation boundaries).

Emergency evac insurance covers the costs of having to book a last minute flight (which can be expensive) and will also cover accommodation costs if you end up being flown to a random, “safe” country rather than going straight home.

Trip Cancellation

Being forced to cancel a trip you were looking forward to sucks. But being left out of pocket just rubs salt into that festering wound. Trip Cancellation cover can help you recover non-refundable costs such as booked flights and hotel costs.

Note that you can’t claim under this simply because you changed your mind or broke up with your boyfriend. Acceptable cancellation reasons are things like sickness, family emergencies, bereavement, natural disaster and war – you get the gist.

Trip Interruption

Trip Interruption is when something goes wrong with a part of your trip leaving you out of pocket. For example, when your hotel burns down and you are forced to book another one. Or when your flight home is cancelled and you need a few extra nights at your hotel. These are just a few examples of when you may need to reply on trip interruption.

Anything Else?

The above is what we consider to be the basic, bare-bones of travel insurance policies. However, some policies do offer a few more aspects and the best Netherlands travel insurance policies may also offer the following;

Adventure Sports and Activities

Note that some travel insurance policies do not cover adventure sports and activities. The definition of adventure sports and activities does vary between providers but for example, can include;

- Trekking

- Rafting

- Muay Thai

- Paragliding

- Diving

- Soccer practice….

If you are even considering doing anything physical or outdoorsy on your trip, it is wise to check that your insurance provider is covering it. Broken ankles hurt enough without having a $5k Doctors bill attached to them.

Accidental Death and Dismemberment

This one doesn’t cover any travel related expenses but instead it basically provides you, or your family with some compensation in the event that something awful happens to you. If you die, your loved ones get a payout. Or, if you lose a finger or something, YOU get a payout.

It’s like having a bit of life cover attached to your travel insurance. I know that not everybody is altogether comfortable with the concept of pay-outs for life & limb – I guess it kind of goes something like this;

“Well dear, I’m afraid there is good new and bad news. The bad news is that our beloved son little Jimmy died on his trip to Netherlands. The good news is that we get $10k! Netherlands here WE come!”

Gear and Electronics Cover

Some insurance policies cover electronic gadgets and some don’t. Those that do, may charge an additional fee, and they generally limit the maximum item value. If you only travel with a phone or tablet, your travel insurer may well cover it entirely. On the other hand, if you are traveling with a decent laptop then you may wish to consider obtaining gadget cover.

I have personally had gadget cover on my MacBook Pro for years.

A new country, a new contract, a new piece of plastic – booooring. Instead, buy an eSIM!

Jetpac eSIMs work just like an app: you download it, pick your plan, and BOOM! You’re connected the minute you land. It’s that easy.

Read about how e-Sims work or click below to see one of the top eSIM providers on the market and ditch the plastic.

Grab an eSIM!What Is The Best Netherlands Travel Insurance?

It is fair to say that not all insurers are created equal. Some offer lower prices than others and others offer more comprehensive cover. Some are notorious for shirking cover whilst others are applauded for their excellent customer service.

Travel insurers are all the same yet always different, and it is absolutely not the case that any one of them is the best, or is “better” than the others. Insurance is a complex product that takes into account a whole lot of data and a wide set of variables. The “best” travel insurance always depends on where you are going, when you are going there, and ultimately upon you and your needs.

Below, we will introduce a few of the many travel insurance providers on offer. These are firms we have used ourselves over the years.

| What is Covered? | Iata Seguros | SafetyWing | Heymondo Single Trip Plan | Columbus Direct |

|---|---|---|---|---|

| Emergency Accident & Sickness | $200,000 | $250,000 | $10,000,000 | $1,000,000 |

| Baggage & Personal Property | $1000 | $3000 | $2,500 | $750 |

| Emergency Evacuation and Repatriation | 100% of cost | $100,000 | $500,000 | $1,000,000 |

| Non-Medical Emergency Evacuation | $0 | $10,000 | $10,000 | $0 |

| Trip Cancellation | $1,500 | $0 | $7,000 | $1,000 |

| Trip Interruption | 100% of cost | $5000 | $1,500 | $750 |

SafetyWing

SafetyWing is a very interesting travel insurance company. They specialise in covering digital nomads and offer open ended cover on a monthly subscription basis. Note that because they are primarily covering digital nomads, they don’t offer much in the way of trip cancellation or delay.

They do however excel on the health side of travel insurance, covering dental and some complimentary treatments, and they even allow young children to be covered for free. If cancellation and delay is not a concern for you or you will be spending some considerable time on your trip, then maybe SafetyWing are right for you.

- Emergency Accident & Sickness Medical Expenses – $250,000

- Baggage and Personal Property – $3000

- Emergency Evacuation and Repatriation – $100,000

- Non-Medical Emergency Evacuation – $10,000

- Trip Cancellation -$0

- Trip Interruption – $5000

If you need more information or want to get a quote, then you can visit the website for yourself.

World Nomads

World Nomads travel insurance has been designed by travelers for travelers, with coverage for more than 150 activities as well as emergency medical, lost luggage, trip cancellation and more.

World Nomads provides travel insurance for travelers in over 100 countries. As an affiliate, we receive a fee when you get a quote from World Nomads using this link. We do not represent World Nomads. This is information only and not a recommendation to buy travel insurance.

Faye

The savvy fin-tech insurer Faye provides whole-trip travel coverage and care that brings out the best in each journey with industry-leading technology that enables smarter and smoother assistance with faster claims resolutions. Their excellent app-based travel insurance covers your health, your trip and your gear all via an app that provides real-time proactive solutions, quick reimbursements and 24/7 customer support.

If you ever do need to make a claim, then you simply log in to the app and the claim will be assessed super quickly from anywhere in the world! My friend made a claim and was able to manage everything directly on the app. She was even able to purchase ‘Cancel for Any Reason’ Insurance that allows you to quite literally cancel for any reason, and be refunded up to 75% of non-refundable bookings.

Best of all, if the claim is successful then the funds will be immediately credited to the smart wallet on your phone or device and ready for you to spend.

Columbus Direct

Named after one of history’s greatest (and most divisive explorers), Columbus Direct also specialise in insuring adventure-hungry explorers like us. They have been providing award-winning insurance for 30 years. What we like about this plan is that it does cover small amounts of personal cash. However, Gadget Cover is not available.

Columbus Direct actually offers a number of different travel insurance plans. Below we have focused on 1 of these and have set out the coverage amounts for the Globetrotter plan.

- Emergency Accident & Sickness Medical Expenses – $1,000,000

- Baggage and Personal Property – $750

- Emergency Evacuation and Repatriation – $1,000,000

- Non-Medical Emergency Evacuation – $0

- Trip Cancellation -$1,000

- Trip Interruption (“Catastophe”) – $750

If you need more information or want to get a quote, then you can visit the website for yourself.

Iati Seguros

Iati Seguros is a Spanish based travel insurance company who we have personally used and loved. You will notice that they provide competitive cover amounts for the key travel insurance areas, and are competitively priced. So far we have heard nothing but good things about them.

They also offer multiple ones, but we have focused on the Standard Plan although we wholly encourage checking out all plans for yourself to identify the best one for your needs.

Standard Plan

- Emergency Accident & Sickness Medical Expenses – $200,000

- Baggage and Personal Property – $1000

- Emergency Evacuation and Repatriation – 100% of cost

- Non-Medical Emergency Evacuation – $0

- Trip Cancellation -$1,500

- Trip Interruption – 100% of cost

If you need more information or want to get a quote, then you can visit the website for yourself.

Insure My Equipment

Insuremyequipment.com is an online insurer for expensive equipment (like camera gear). You can get specific pieces of gear insured so you know exactly what will be covered. Note that this policy is for your gear only.

An Insure My Equipment policy works well in combination with other travel insurance. Insure My Equipment policies are an excellent choice for professionals and backpackers with more than $3000-$4000 worth of camera equipment or expensive laptops.

How To Choose The Right Netherlands Travel Insurance For You

Choosing the right travel insurance for your Netherlands holiday is like choosing a wife, it is something only you can decide (unless your Indian in which case your parents will do it). You need to work out how much your trip is worth, how much equipment you plan to take and what activities you intend to engage in.

And of course, you need to ask yourself how much can you afford – how much you can afford to pay for cover, and how much you can afford to be out of pocket in the unlikely event of a claim. Sometimes, the cheapest Netherlands travel insurance will be enough and sometimes it will be worth spending a bit more. Hopefully the information provided in this post will help you to decide – if not, then I just wasted 5 hours of my life in writing it!

Final Thoughts on The Netherlands Travel Insurance

Nice one, you made it all the way to the end. Now your mind is swimming with all kinds of stats and facts about healthcare, crime, and safety in the Netherlands. When it comes to making that big decision about the Netherlands travel insurance, the ball is in your court. Mull over our advice, shop around, and decide what’s best for you.

And now, over to juicier topics. Where are you going to stay in Amsterdam? Where in the country will you get your Dutch pancake fix? We’ve got heaps of content for you to sink your teeth into to plan the best trip to the Netherlands. Happy travelling, and keep safe!

Buy Us a Coffee!

A couple of you lovely readers suggested we set up a tip jar for direct support as an alternative to booking through our links. So we created one!

You can now buy The Broke Backpacker a coffee. If you like and use our content to plan your trips, it’s a much appreciated way to show appreciation 🙂